EMPLOYEE BENEFITS PLATFORM - SANTÉFLEX

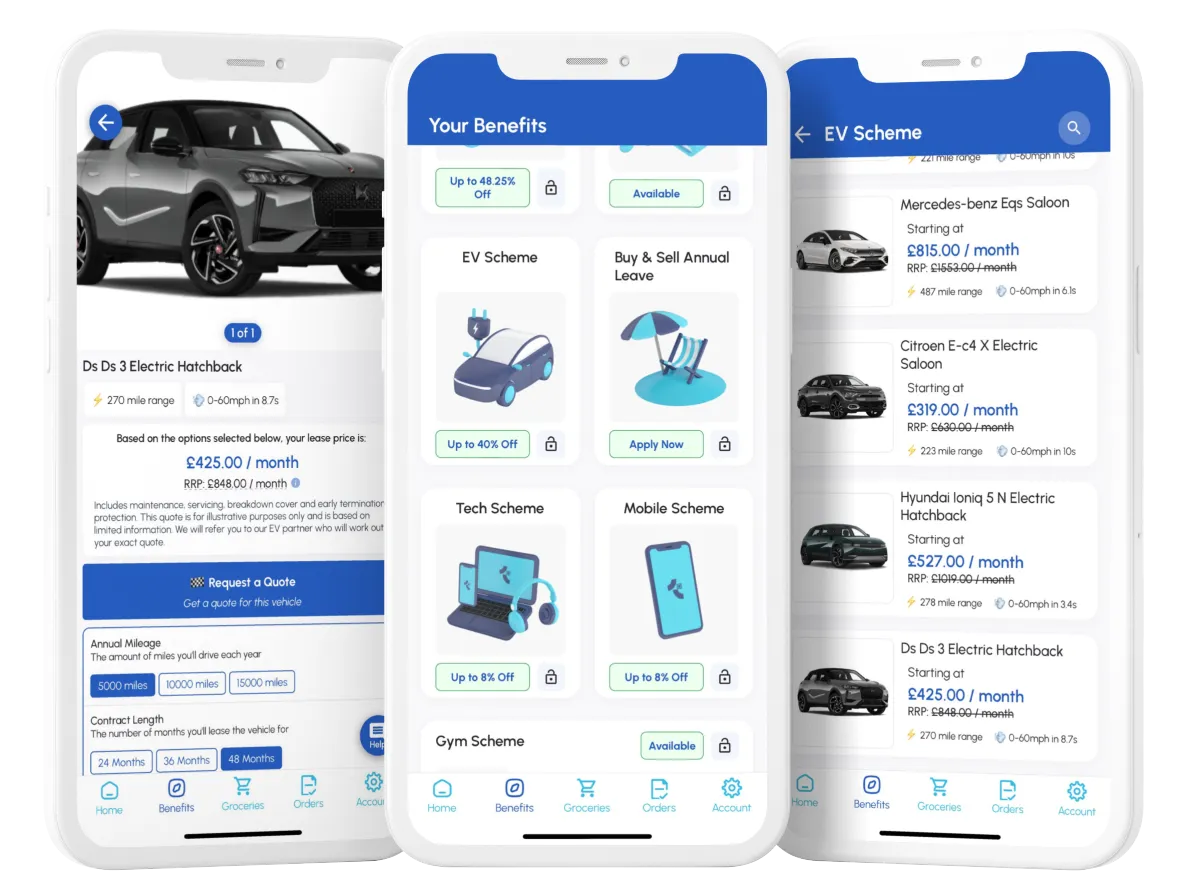

Electric Vehicle Scheme

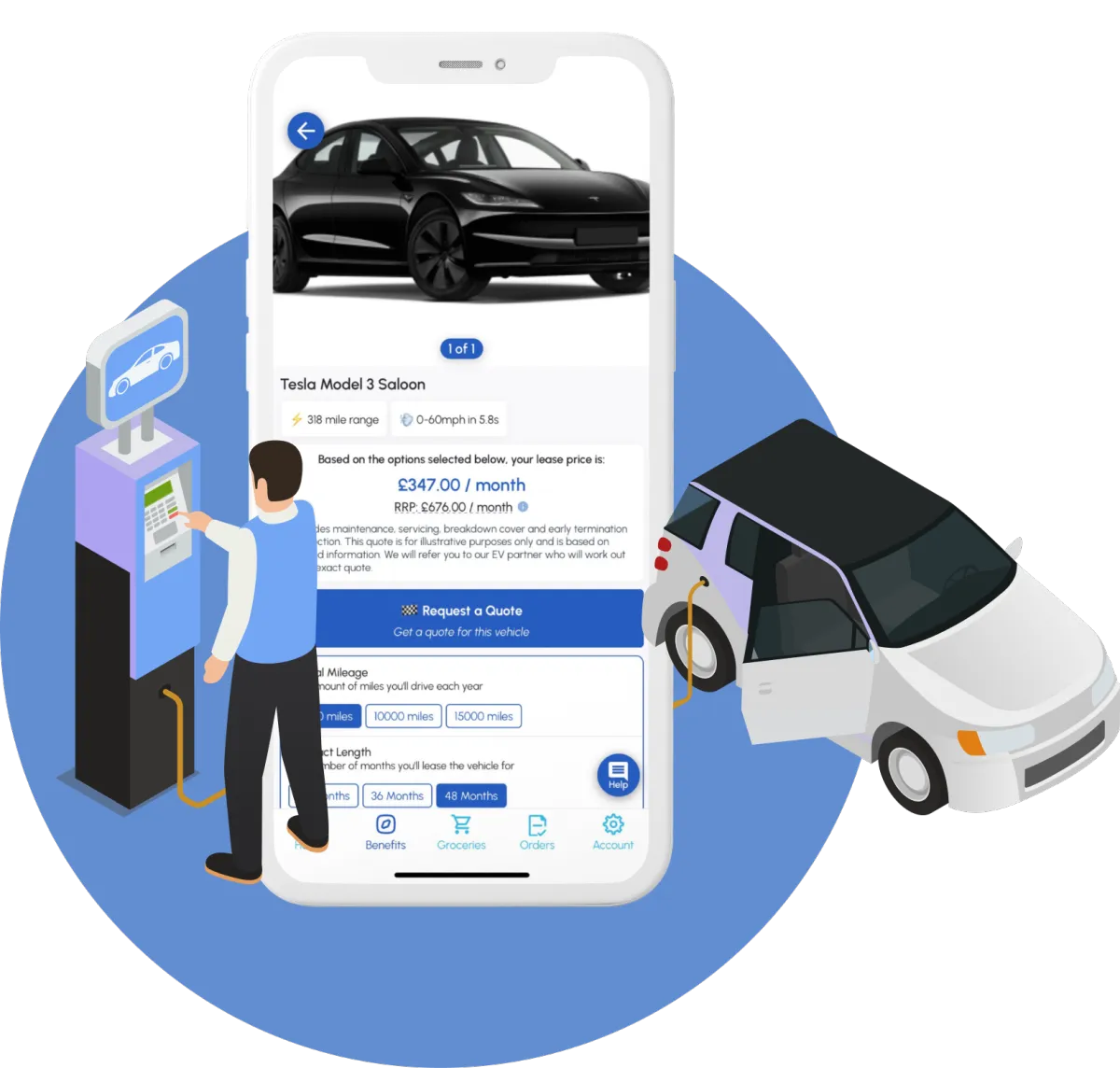

The Electric Vehicle Scheme is a tax-efficient employee benefit that allows employees to save significant sums on an electric vehicle lease. The EV Scheme is a government-backed benefit that encourages employees to go green and switch to electric vehicles.

How does it work?

Employees participate in the Electric Vehicle Scheme by sacrificing a portion of their salary in exchange for an electric vehicle lease, which usually includes insurance and maintenance. The lease is acquired under the employer's name, spanning 18-24 months, though the duration may vary. The lease cost is divided into monthly instalments throughout the agreement period. The deducted amount is processed from the employee's gross salary, leading to tax and National Insurance savings.

EMPLOYEE BENEFITS PLATFORM - SANTÉFLEX

Why should I offer the Electric Vehicle Scheme benefit to my employees?

Employees save on National Insurance contributions and pay a significantly reduced Benefit in Kind (BiK) tax rate, which is currently only 2% and will remain at this rate until April 2025. From that point, it will increase by 1% year-on-year until 2028.

Offering the Electric Vehicle Scheme benefit to your employees provides multiple advantages. It demonstrates your commitment to environmental sustainability, acts as a powerful employee retention and attraction tool, and enables employees to save on National Insurance contributions and benefit from tax incentives, enhancing their compensation package and fostering loyalty and job satisfaction.

FAQs

Who supplies the EV?

Electric vehicle leasing is brokered by our partner, Love Electric, through their network of leasing partners, meaning they have a vast range of vehicles at the most competitive rates. The benefit is fully managed through the SantéFlex platform, so you can expect the same unique experience.

How does approval work?

You set the parameters beforehand and dictate who qualifies for salary sacrifice, how much they spend, and when. You can either auto-approve or manually approve, depending on your preference. You can even set windows on when the benefit can be accessed.

How does Love Electric compare to others?

Our partner is an independent broker; they search for the best price deals from a range of leading leasing companies. The prices you see on our site are the prices you'll get—inclusive of servicing, maintenance, early termination protection service, and their fee—keeping it clean and simple.

Will my company be eligible?

We want to support all businesses, big and small, in empowering their staff to make the switch to electric. However, the scheme won’t be right for every company. A good rule of thumb is that businesses in our scheme should have been trading for at least 2 years and be profitable.

What level of admin is involved?

If you set parameters beforehand, there is no admin on your end, besides the payroll configuration which is usually straightforward. If you decide to manually approve the order, this will require you to review and approve each request.

How does tax saving work?

The Electric Vehicle scheme operates through a salary sacrifice arrangement. In this setup, employees voluntarily agree to sacrifice a portion of their salary, which is used to fund the vehicle lease. This sacrificed amount is exempt from National Insurance contributions and benefits from a reduced BIk rate of 2% leading to substantial tax savings for the employee.

Who is eligible for this benefit?

In order to qualify for salary sacrifice, the sacrificed amount cannot reduce an employee's earnings below the national minimum wage.

What happens if my employee leaves?

We provide early termination protection as standard. This means that if your employee needs to terminate the lease early, several options are available to you. The first option would be to transfer the contract to another employee.

The second option would be to transfer the lease to a new employer (if applicable).If neither of these options are feasible, don’t worry, we will protect the employer against any early termination charges levied by the leasing company. All your employee will need to pay is an administration charge of one month’s rental. Ts and Cs apply.

Missing questions?

Email Us

Call Us

08081713434

Address

Santé Group, 523 Garstang Rd, Broughton,

Preston, PR3 5DL