EMPLOYEE BENEFITS PLATFORM - SANTÉFLEX

Cycle to Work

A cycle-to-work scheme is a tax-efficient employee benefit that allows individuals to purchase bicycles and cycling equipment through salary sacrifice, promoting a healthier and eco-friendly commute to work. It enables employees to save money while encouraging physical activity and reducing carbon emissions.

How does it work?

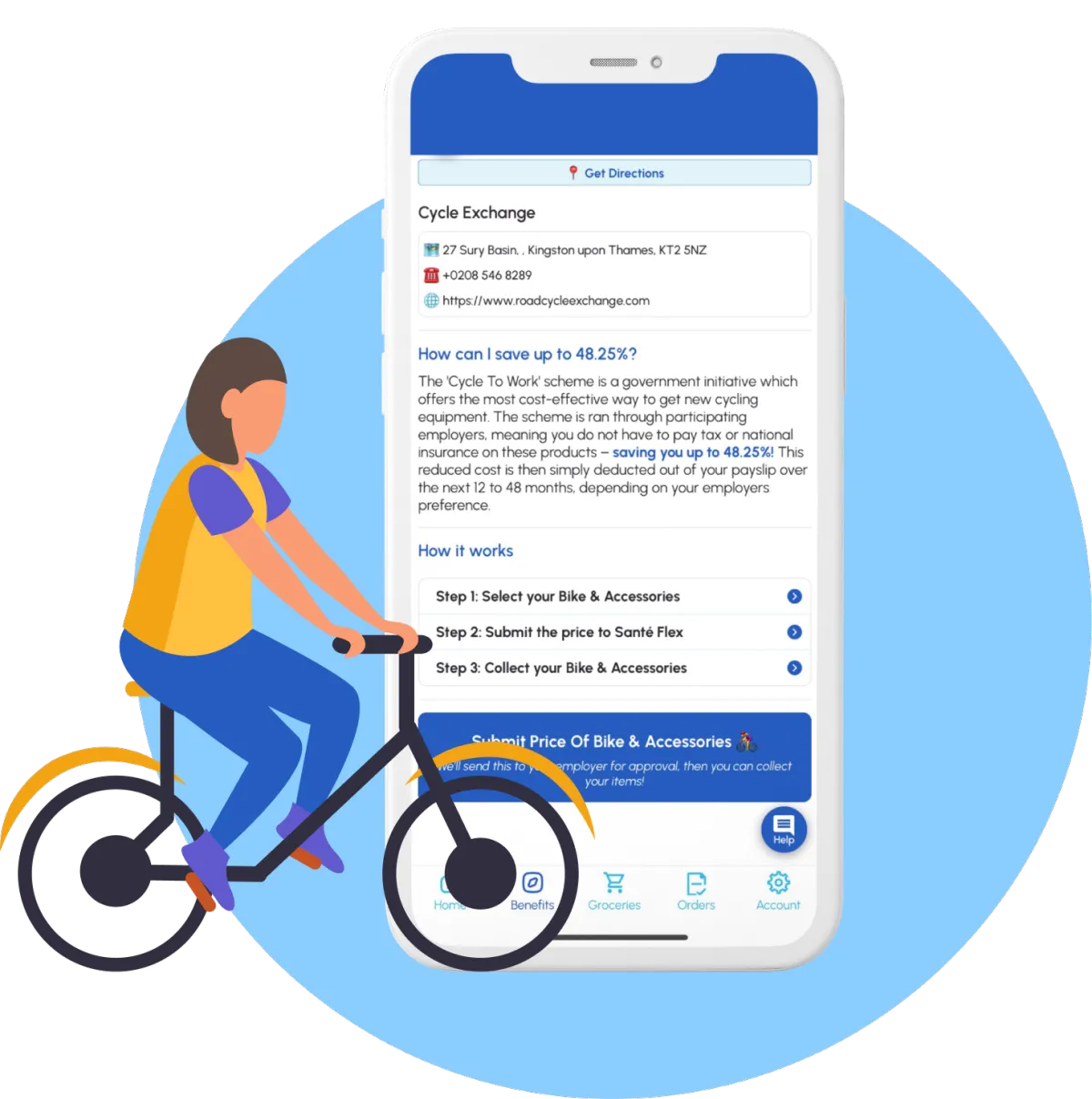

Employees give up part of their salary in return for a bike and/or cycle equipment. As the employer, you pay for it upfront and deduct the cost over 12 months from their gross pay. The bike cost is deducted in equal monthly instalments over the duration of the agreement. The deduction is processed from their employee's gross salary, wherein the tax and National Insurance savings are realised.

EMPLOYEE BENEFITS PLATFORM - SANTÉFLEX

Why should I offer the Cycle to Work benefit to my employees?

The Cycle to Work scheme is a government-incentivised benefit. This means employees will save both tax and National Insurance, and as an employer, you will save on your employees' contributions too.

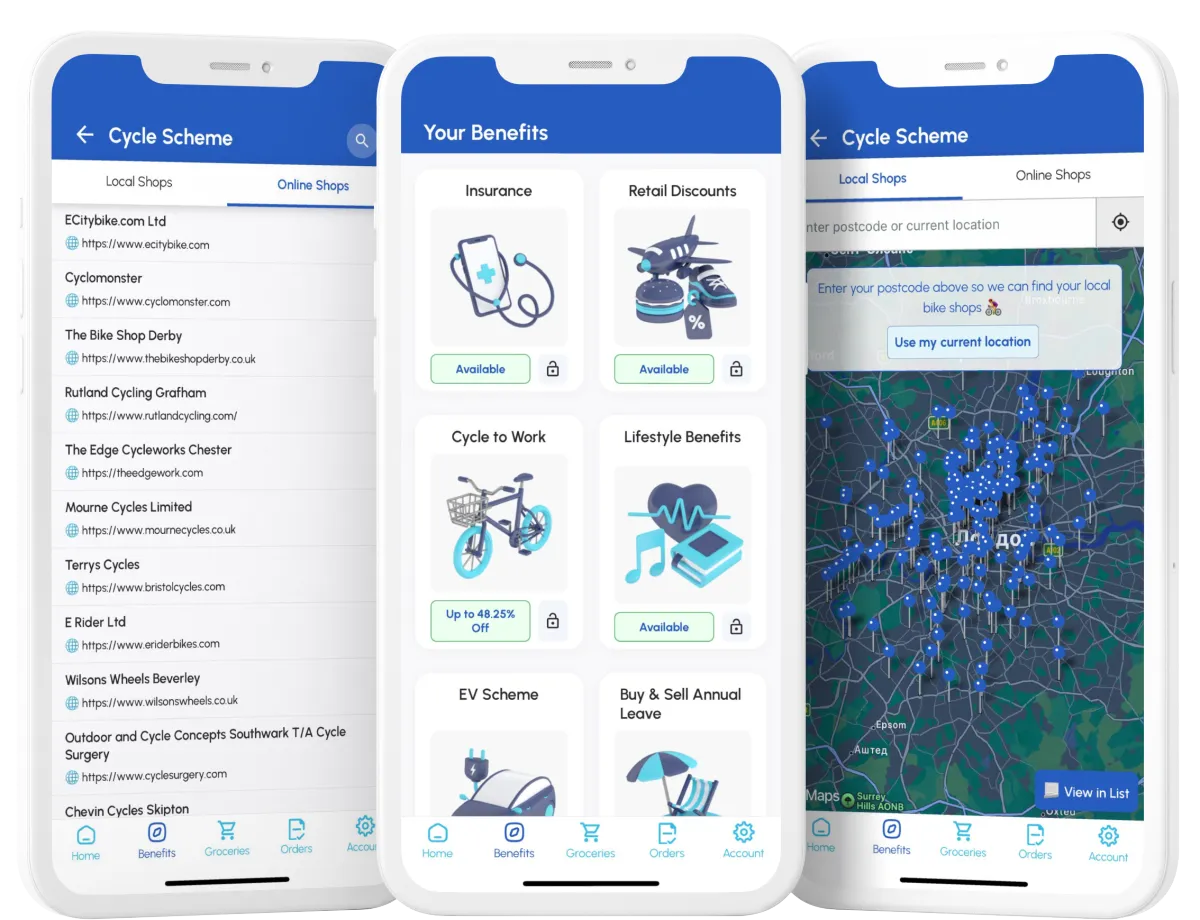

Our cycle-to-work scheme is designed to make things more convenient for you by integrating with all your benefits, eliminating the need for separate processing. With simplified admin and you in control of the setup, the experience is seamless and hassle-free. There are no limitations on bike availability, so employees can get the bike and equipment they need.

FAQs

Who supplies the products?

We've partnered with Bike2Work to offer this benefit. The program is fully administered, meaning you only deal with one party (us!). Any bike shop can be accessed, and no end-of-hire charges apply.

How does approval work?

You set the parameters beforehand and dictate who qualifies for salary sacrifice, how much they spend, and when. You can either auto-approve or manually approve, depending on your preference. You can even set windows on when the benefit can be accessed.

How does your Cycle to Work differ from others in the market?

As a Cycle to Work provider, we have no limits on which bike shops can be used and no end-of-hire fees. These are the two main things to consider when looking for a Cycle to Work scheme.

We're also a platform broker, meaning all our benefits, including the Cycle to Work program, are directly integrated on one platform. This means you don't have to have a completely separate solution for each of your benefits. This makes communicating benefits, administration, and utilisation much better.

What level of admin is involved?

If you set parameters beforehand, there is no admin on your end, besides the payroll configuration which is usually straightforward. If you decide to manually approve the order, this will require you to review and approve each request.

How does tax saving work?

The Cycle to Work scheme operates through a salary sacrifice arrangement, enabling employees to acquire bicycles and related accessories via their employer. In this setup, employees voluntarily agree to sacrifice a portion of their salary, which is used to fund the purchase of the bike. This sacrificed amount is exempt from income tax and National Insurance contributions, leading to substantial tax savings for the employee.

Who is eligible for this benefit?

In order to qualify for salary sacrifice, the sacrificed amount cannot reduce an employee's earnings below the national minimum wage.

Does my company have to pay for the bike upfront?

Yes. You are invoiced for the full value of the bike and equipment. We need to receive payment before we can provide the employee with the cycle-to-work voucher.

Are there any end-of-hire fees?

No! Unlike some of the providers in the market, we do not charge end-of-hire fees.

What’s the length of the contract?

This depends on what minimum and maximum you’d like to set. However, employers typically offer 12, 18 or 24-month contracts.

Which bike shops do you work with?

As a cycle-to-work marketplace, we have no limit on who we work with. If an employee would like a bike from a retail store not listed on our platform, they simply need to contact us, and we'll ensure we can get them the bike they need.

Are there any limits on bike value?

No. However, you are able to set a limit if you wish.

Missing questions?

Email Us

Call Us

08081713434

Address

Santé Group, 523 Garstang Rd, Broughton,

Preston, PR3 5DL